“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back”

― John Maynard Keynes, The General Theory of Employment, Interest and Money

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design”

― F. A Hayek, The Fatal Conceit

TLDR:

I recently wrote an article about Autonomous Organizations1 describing how AI tools are increasingly being leveraged to automate businesses. AI disruption of the labor markets has been a significant topic over the past few years. It has affected creative industries, like art, marketing, and writing, and increasingly technical disciplines like software engineering, law, and medicine. Like any disruptive technology, there is often a required reskilling of the workforce. The speed of implementation of AI, however, makes this challenging. The economic impact may be significant.

This article is about this trend but sets it in a larger context -- that of the economic policy and actions of the current federal administration. The first few months have been characterized by economic and geopolitical chaos, but there is very little explanation as to why or what the goals are, apart from vague slogans like "Make America Great Again", or the "External Revenue Service".

This article aims to describe in an accessible way what is happening, economically (and geopolitically) with the shared context of what is happening in technology, notably AI. By the end of the article, the reader should have a good understanding of why certain things are happening and what the implications are for them.

Contents:

This article is divided roughly into three main parts. The first two parts are intended to set a up a history of key economic ideas, the development of the global economy, and the evolution of the domestic economy, notably around policies that have increased income inequality and the impact of money in US politics.

The third part discusses current and future events for geopolitics, economic policy and technology. Naturally this part is more forward looking and speculative and is intended to provide a framework for debate.

Part 3 - Current and Future State

Summary

The central narrative of the current administration used as justification for economic and geopolitical actions is that the United States has been taken advantage of for too long by too many countries. This narrative has references to unfair economic practices like currency manipulation, free-riding US military spending by NATO countries, and various forms of unfair treatment, for example, the claim that Panama charges the US more for transit across the Canal (it does not). This is a victim-centric perspective. In the current US environment, it resonates as populism, because many individuals have felt taken advantage of with stagnating wages, loss of manufacturing jobs, and general economic malaise. The message is that other countries are hurting the US, but the reality is different.

The US is, by far, the dominant country in the world. It has become so through an expansive investment in global stability after WW2 through economic investments, military security projection, and dedication to strong and lawful institutions. The US is the only country that has widespread military bases in other countries, and it benefits greatly from it. The US also has a deteriorating economic core, with rapidly increasing debt and unsustainable future obligations. This is not an externally imposed circumstance, it is a direct consequence of decisions that the US has made around spending, tax policy, and its emphasis of maintaining global hegemonic power through military might.

The role of the US as the sole global superpower combined with a nearly bottomless demand for US dollars which makes the dollar strong, has enabled it to indulge in economic insolvency which to date, has produced a high global standard and cost of living. However, this has created a challenge for the future. US products and labor are expensive making them less attractive to the rest of the world. In contrast, the US dollar is the most dominant reserve and transactional currency, on account of the large size and stability of the US economy, rule of law, and predictable regulatory environment. The world wants US dollars more than US products. This has allowed the US to print and sell money almost indefinitely. The central question then becomes how the US makes money. The US has failed to do this effectively for two reasons:

External Drivers: Foreign countries want US dollars but do not want as many US products -- this is the central reason being championed by the current administration

Internal Drivers: The US fails to effectively tax and manage costs for government services for its own citizens. Inefficient tax policy and high costs, for example, for inefficient and fragmented medical care, continue to erode the domestic financial condition.

These reasons will be addressed in further detail in Parts 1 and 2, respectively.

The policy of the current administration, which is addressed in Part 3, to address this is radical and contradictory. The goal is to maintain the importance of the US dollar as a global reserve currency while simultaneously making American exports more attractive. These two goals are considered to be inconsistent in general, however, in a world where the cost of production can be radically reduced, this dynamic may be possible. This is where AI comes in. The impact on the labor markets will both expand productivity and potentially dramatically reduce the cost of labor. One of the stated goals of this administration is to "dramatically increase the labor supply"2 -- this is another way of stating depressing wages and/or increasing unemployment. The context is to reduce inflation, but the net effect is reduced wages and aggregate demand. This takeover of the US government by Silicon Valley accompanies a form of "TechnoMonarchy" which sees Al and automation replacing current production paradigms. This is being sold as a future of abundance -- however, if the history of US economic policy is a guide, it will only super charge resource inequality in the world. This outcome, however, is unlikely in the near term. The reestablishment of a widespread US manufacturing core and/or the mass adoption of AI and automation will take time. In the interim, the protectionist economic policies being pursued are more likely to increase global isolation, damage foreign relationships, and increase economic uncertainty and costs around the world.

Part 1 — External Drivers

Part 1 reviews history and economic topics that provide context for the the development of the global economy and the role of the US.

The Pax Americana

The 1900s set the stage for the current geopolitical and economic setting largely defined by the impact of the two World Wars. At the end of WW1, much of Europe was destroyed and the Treaty of Versailles defined how the Allied Powers (US, UK, France, Italy) would treat Germany. John Maynard Keynes wrote a policy narrative called "The Economic Consequence of the Peace" where he strongly argued that the Allies should not be punitive against Germany -- that doing so would only exacerbate the dire state of the country and create a fertile ground for another radical dictator. They were punitive, and the desperate economic circumstances of Germany were a major factor in the rise of Hitler.

The lesson learned at the end of the Second World War was that the US took an exactly opposite approach. Instead of being economically punitive, the US invested heavily in rebuilding Europe, including West Germany, and Japan. This same philosophy was taken in supporting South Korea after the Korean War. This philosophy, that investing in stable and prosperous allies around the world, was extremely beneficial for the US and has produced some of the largest and most prosperous countries, trading partners, and allies around the world. The US bore the cost of much of this investment, and today, is the only country that has a widespread military presence around the world. The economic investment in industry and military applications led the US to become a dominant manufacturing power. This period also had a very progressive tax policy, with a top marginal tax rate of 90% which funded this government investment along with an expansion of social programs.

However, increasing government spending, largely driven by the Vietnam War and expanding social programs, combined with foreign countries redeeming their USD for gold and depleting US gold reserves, led the Nixon administration to abandon the gold standard and float the US currency, which also decoupled other global currencies from the USD (prior to this, per the Bretton wood Agreement post-WW2, many currencies had been pegged to the dollar with fixed exchange rates).

The new fiat currency also enabled a much more expansive fiscal and monetary policy now that USD was no longer redeemable in gold. This set up conditions for the ability to freely print money.

The 1980s under Reagan marks the beginning of the policies that have led to the current economic situation -- specifically it started a very long-term and continuous decrease in tax rates, both corporate and individual. The thesis of "trickle-down economics" is that providing more capital to capitalists would result in broader economic prosperity writ large as that capital trickled down through the economy. This turned out to be very wrong and is detailed in the section below on Taxes, Inequality, Debt.

The 1990s were the last time that the US had a balanced budget. This was supported by both strong economic growth and tax policies early in the first Clinton administration which increased taxes on corporations and high-income earners. This economic growth which actually provided for government surpluses set the stage for tax cuts later in the Clinton administration and progressive deregulation notably of the banking industry by the Republican congress's bill to repeal parts of the Glass-Steagall Act that separated commercial and investment banking. This set the stage for large banks to intermingle their business which, when combined with a series of deregulations in the GW Bush administration set up the subprime lending crisis and the 2008 financial crash. At the end of the Clinton administration in 2000, the US debt stood at $5.6T -- 25 years later it is nearly $36T.

Since 2000, there have several major events that have driven the US debt.

The attacks on 9/11 that led to the Iraq and Afghan war and an expanding US security state

Tax cuts during the Bush and first Trump administrations have added an estimated $10T to the US debt

Recovery spending from the 2008 financial crisis and the 2020 COVID pandemic has added several $T to the debt

Interest accrual on the debt which accelerated accrual with deficit spending under GW Bush because of tax cuts and war spending has consistently grown to add $1T per year now to the debt

An aging population that draws more from Social Security and Medicare specifically -- it is important to note that the economics of these programs have not meaningfully changed apart from COLA adjustment to Social Security and continually increasing medical costs independent of Medicare. The outlays have grown but the mechanics of the programs have not

These are all significant factors in driving the current economic situation and they have largely developed over the last 25 years. It was estimated during the Clinton administration that the budget could be sustained for at least 65 years under their projections, but intervening events have certainly shifted that3.

Economic Primers -- Reserve Currencies, Exchange Rates, Tariffs

The US has a unique position in the world, it has the dominant reserve currency. Other reserve currencies include the euro and to a lesser extent, the yen.

A reserve currency is a currency that other countries want to hold for economic security. Of all of the currencies in the world, the US dollar is considered the most stable and as such, if a country wants to have a stable asset, it will often buy US dollars, this happens in the form of debt (US Treasury Bills which have to be purchased using USD) and actual dollars. The USD is also a primary currency for global transactions. This status creates a demand for USD which increases its value compared to other currencies that are not in demand. This has several benefits for the US but also comes with some downsides. The primary benefit is that this allows the US to spend more than it earns. There are always other countries that will want to buy US debt (likely up to a point, but it has been the case so far). The demand for the dollar relative to other currencies also makes it cheaper for the US to import goods which keeps domestic import prices lower. The downside is the opposite -- a strong dollar means generally higher labor and production costs in the US and consequently fewer desirable exports. This is a central trade-off. The US can spend deep into debt without too much concern to fund the military, social programs, and, as will be discussed in detail below, wealth accumulation in a small group, but at the cost of having a potentially imbalanced trade relationship with other countries.

The central key is what it costs to make things in the US compared to other countries. This ties to the value of the dollar (and its relative demand), the economic environment (regulations, wages, efficiency), and the government policy (financial/tax/tariffs/incentives). These are all parts of current US administration's economic policy changes.

Tariffs Can Be Complicated

Tariffs have been a large part of the current administration's efforts in 2025, but for many, this has been confusing. The impact of tariffs can be very complex because of the deep integration of the global economy. One argument is that tariffs are a regressive tax on consumers -- meaning they just make prices higher for imported goods which is just then passed on to consumers, disproportionally affecting low and middle income consumers where increased prices make up a larger portion of their spending. The other argument is that tariffs are a tax on foreign countries. Both statements are at least partially true.

The impact of tariffs is both direct and indirect. The direct part is just the tax that is levied, and the indirect part is the impact of the tariff on the economy of the tariffed country that can impact the exchange rate of the currency. The US is a large market -- a threat of tariffs on another country may create an expectation that said country will have a lower demand for their products which may reduce the desire for their currency. This reduction in the value of their currency can subsequently make imports less expensive partially offsetting the cost of the additional tariff. This can, in a sense, be considered an implicit tax on the country by inducing a reduction in the value of their currency. In practice, this still generally results in higher prices, but not as high as might otherwise be the case. This happened in 2018 with Trump's first tariffs on China.

Figure 1: An example of the changing currency rates between yuan, euros, and dollars over the last decade. When Trump first imposed tariffs on China in 2018, the yuan became less valuable compared to the dollar which made imports less expensive. This is estimated to offset ~70%4 of the cost of the tariffs themselves. Other major changes include the COVID response. In the early part of COVID-19 under Trump, the dollar was significantly weakened compared to the yuan. This reflected the different responses and expectations of economic recovery -- the very strong lockdowns in China which signaled an aggressive response and the science denialism of the Trump administration which signaled a weak one. As the recovery continued and the US response began to stabilize, the dollar began to strengthen again as demand rose for a secure asset during uncertain times. Increasing economic activity in USD may have also contributed to strengthening the USD. This response was most pronounced with respect to China because the yuan is not a desired reserve currency, and more complex with respect to the euro which, as the second most important reserve currency, had its own complex dynamics with respect to global demand and safety.

The Integration of the Global Economy Makes the Impact of Tariffs Hard to Assess

The arguments above are relatively simple, but the reality is much more complex, particularly in deeply integrated economies when trade wars start and other countries begin to impose retaliatory tariffs, as is happening now. Some complications that can arise -- for example, Harley Davidson, the motorcycle manufacturer has noted that they get impacted negatively on both sides of the trade war even though they are US manufacturers that tariffs are intended to support. They pay more for imported raw materials which increases their cost of goods, and their products are specifically tariffed by retaliation from other countries making their exports more expensive5. Similarly, the argument that tariffs can reduce the currency exchange rate as an implicit tax on other countries is also not clear because if those countries require imported goods themselves to make products, weakening their currency increases their cost of production which increases import costs despite reducing the currency value.

Tariffs are frequently used strategically for international affairs and sometimes their impact is very clear -- for example, European and Canadian tariffs on American bourbon are directly targeted toward impacting the exports of Kentucky and republican states. Often tariffs are on raw materials like steel or fertilizer because they are critical parts of a supply chain, and even small changes in the cost of goods get magnified by producer margins that are added in the many steps of the value chain toward a final product.

Blanket tariffs are an instrument of economic warfare -- the impact is very difficult to assess apart from increasing economic instability, prices, and relational tensions around the world. The use of tariffs to implicitly tax other countries by negatively impacting their currency has the opposite effect of supporting US exports because it makes the dollar more valuable and exports more costly. Any revenue gained from tariffs most often is still accompanied by higher prices across the board as a regressive tax primarily affecting low and middle income consumers.

So, what is the goal of this tariff effort? The objective is to compel countries to do what the US wants both economically and with respect to national security.

Trade and National Security

There are two arguments that are being made for broad-scale tariffs currently and they are roughly related to the two theaters that the US uniquely operates in - both Pacific and Atlantic.

Countries have been "cheating" the US "unfairly". The primary complaint is through currency manipulation where countries artificially reduce the value of their currency to make their exports more attractive, resulting in a trade imbalance. There does exist a trade imbalance in goods (or products) with both China and Europe, though the overall trade imbalance when considering services is very low with Europe. The goods trade imbalance is primarily related to the cost of production and demand. This is primarily a complaint against China

Countries haven't been paying their fair share. This complaint is primarily related to NATO and defense spending and is levied at Europe. The overall trade imbalance with Europe is relatively small and prior to Trump's first term, there were very few tariffs between the US and Europe. However, European countries have not been meeting their defense spending obligation under the NATO treaty. This has been the primary complaint and the main driver behind tariff pressure. The line from the administration is the same -- that the US is being "cheated"

The US spends more than the next 15 countries combined on defense spending - many of whom are allies6. This is extraordinary. This is a result of several factors:

The US industrial and military growth starting from WW2 as the only major country that was not physically destroyed in that conflict

The ability of the US to spend beyond its means on account of its position as a global currency reserve

The US is the only major country in the world that borders both major oceans and consequently has a global presence. The US is also the only country in the world with an expansive military presence in other countries -- and these arrangements have benefited the US tremendously by providing stability and security for economic development, trade routes, and deterrence.

The NATO alliance, formed after WW2, is a defensive alliance. The two most salient terms are:

Members will spend 2% of their GDP on defense spending

An attack on one member state will be defended by all (this is Article 5). In the history of the alliance, Article 5 has only been invoked once and that was in response to the September 11, 2001 attacks on the US where NATO member states joined to defend the US7.

Defense spending as a percent of GDP is seen below -- an important observation is that European spending has increased substantially in 2024 in response to the war in Ukraine and threats from Russia. This was prior to any tariff threat from the Trump administration.

Figure 2: NATO spending by GDP %, country, and overall8.

These graphs show two important things

The US spends ~3.5% of GDP on defense and most other NATO countries are below the 2% mark.

The size of the US GDP makes the absolute value of this defense spending a major fraction of overall NATO spending.

However, it is important to note that the US defense spending is not solely dedicated to NATO -- the US has a global presence. The US has a defense budget of ~$900B. If one were to simply take a rough estimate of an equal split in Atlantic and Pacific theaters, this would imply $450B for Atlantic defense -- or 1.5% of a $30T GDP. This is still a significant portion of the overall NATO spending (perhaps ~50%) but that is a consequence of the size of the US GDP, which has been the largest beneficiary of US military spending worldwide.

A more comprehensive assessment of the spending was done by the International Institute of Strategic Studies (IISS) estimated that direct U.S. defense expenses in Europe ranged from $30.7 billion to $36.0 billion in 2017-2018, representing about 5.1% to 5.5% of the total U.S. defense budget9. There are several ways to look at this, but the narrative that other countries have been cheating the US because of not meeting their NATO spending obligations, where the US has been, is a distorted argument. Threats of tariffs to compel countries to do so are akin to a bully who has created and benefited from a stable world system, now aiming to extract value from those who have been part of that system. This paradigm is defining of the current administration -- with Musk himself saying that he came to the US as an illegal immigrant and, after having benefited from the system established in this country, now wants to restrict it for others10.

Tariffs can rightfully be used for strategic and economic ends, and they may be rightfully deployed against geopolitical adversaries like China, but the use of tariffs against allies and more balanced economies like Canada, and Europe, to compel compliance with a misleading or revisionist view of global security is not in the best interests of global security, stability or US leadership in the world.

It is not without mention that Trump's brute force attacks on our allies is encouraging them to seek greater independence from the US, particularly on security matters. But it is important to point out that European increases in military spending were in response to Russia's attack on Ukraine and preceded Trumps threats11. The net effect if Europe independently sustains this higher level of defense spending by viewing the US as an unreliable country will result in a more weaponized world in general and will not result in reductions of military spending in the US, nor likely any improved relations or economic benefit. It is important that countries respect their treaty obligations, but it also arguable, that the US is not either in this case (at least with respect to funds allocated to NATO).

Part 2 — Internal Drivers

Part 2 reviews US domestic policies and trends that have led to the current economic and political environment.

Taxes, Inequality, and Debt

The US has a $36T national debt (120% of national GDP). In 2000, this was approximately $5.6T (~55% of national GDP). The accumulation has been extraordinary and is accelerating. This has been possible largely on account of the dollar being a reserve currency, as described above, the ability of the US to print debt is a benefit of this status and foreign governments currently hold about $8-9T in US debt and currency12. It is widely recognized that the current paradigm is not long-term sustainable, largely on account of the increasing portion of interest payments as a fraction of the federal budget.

The accumulation of debt is a consequence of the government spending more than it makes and doing so continuously. This can be caused by making less money, spending more money, or both. Continuously doing this exacerbates the issue by compounding the interest payments which will shortly cost over $1T (~16% of the budget).

The delta between what the government spends and earns is an accumulated pool of capital -- and it has to be found somewhere -- it does not simply disappear. In the US, this capital is found being pooled at the top end of the wealth spectrum. This is very straightforward. This process of reducing taxes has oscillated between administrations over the last several decades but started in earnest during the Reagan years. Prior to this, in the "golden ages" of the American economy, top marginal tax rates were 90%. Once this trend of reducing taxes started in earnest, even though it may have been cyclical, for example, Reagan cutting taxes, Clinton raising them, Bush cutting them...etc., because taxes were primarily on income, the cumulative nature of asset acquisition has become dominant. This is a compounding issue, and the accumulation of asset wealth over time has vastly outweighed the accumulation of income wealth, however, the process starts through reduced taxes on income wealth, particularly for high incomes, which results in excess capital then used to acquire assets and the compounding starts.

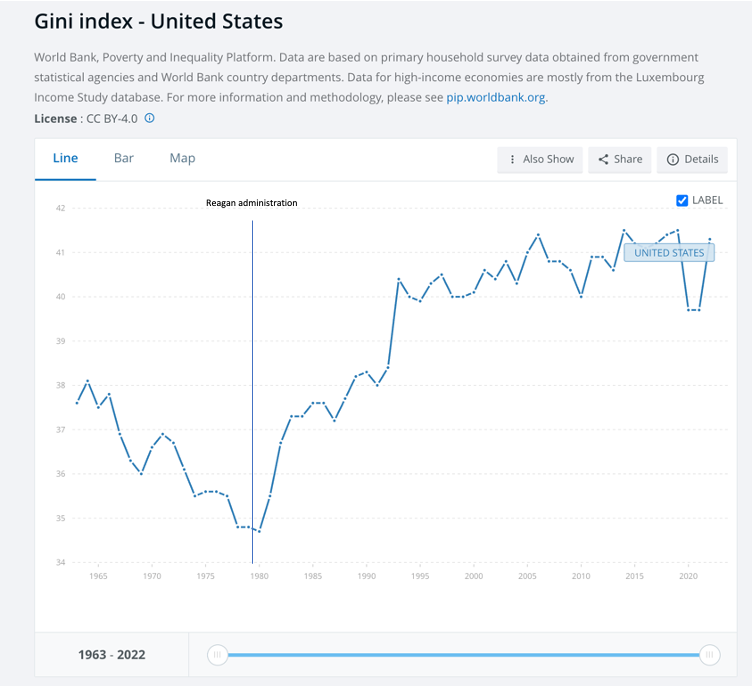

The effect of this is seen very clearly in the inequality index for the US.

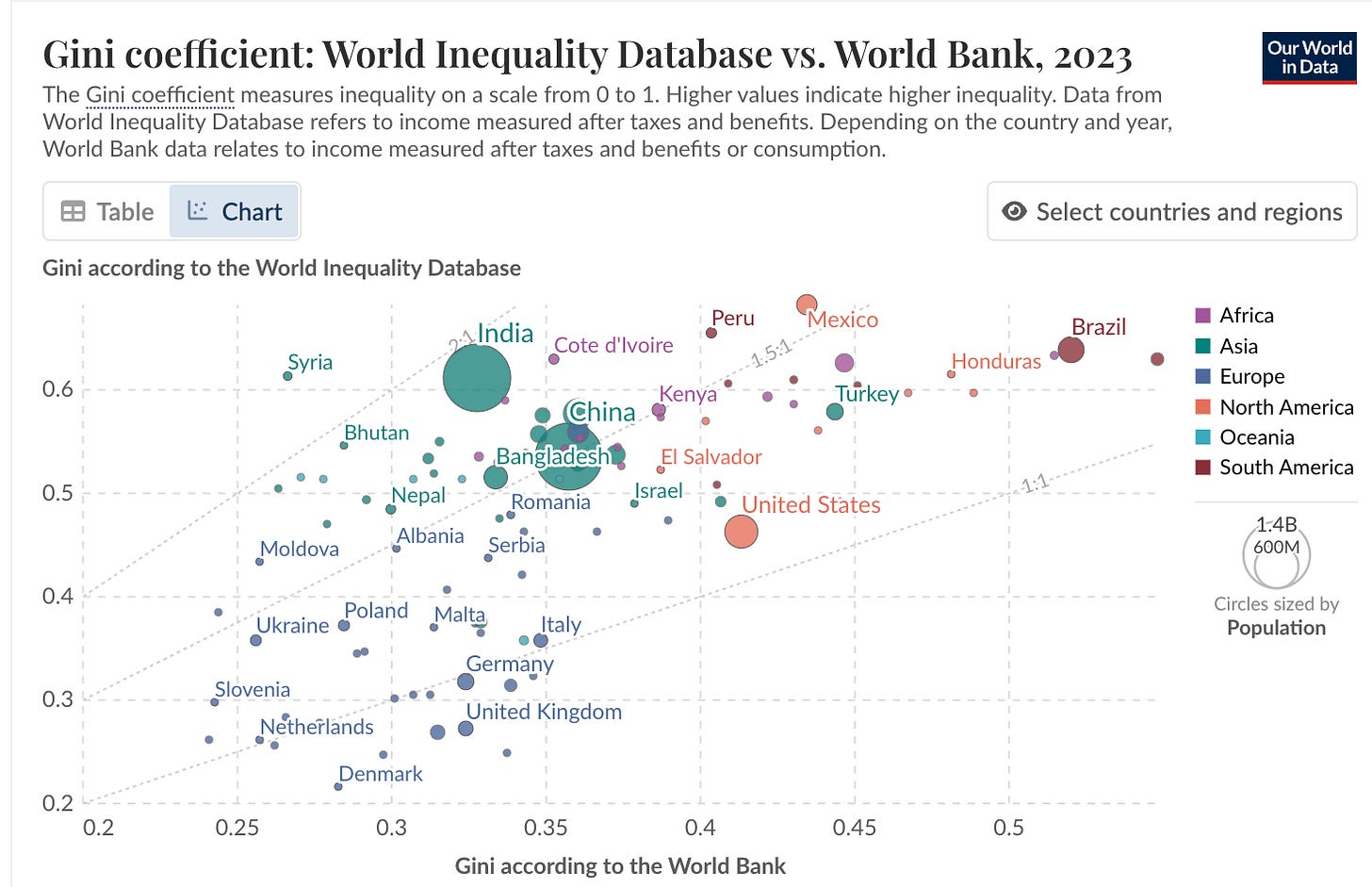

Figure 3: The Gini Index is a measure of economic inequality. Top13: US Gini Index increases over time. Botton14: The current global range is: low ~24 for Slovenia and a high of 63 in South Africa/Colombia. The EU roughly comes in at ~32)

Figure 4: Tracking the federal debt as a % of GDP also indicates that increases began in ~1980. With a few reprieves during the Clinton administration when the budget was last balanced, the debt has grown either in line with or faster than GDP with major inflections after the 2008 Recession and the COVID pandemic.

The graphs show that since 1980, inequality has increased dramatically and continuously. This has largely been driven by asset wealth accumulation - not income. Similarly, the debt has started to increase over time as well -- the additions to debt are the deficit spending each year. Deficit spending is spending less revenue where government revenue is largely income tax revenue. Reagan cut income taxes -- under the philosophy of "trickle-down economics" meaning that lower taxes on corporations and the wealthy would eventually make its way through the economy -- this meant lower government tax revenue, higher deficit spending, and increasing debt. Clinton balanced the deficit by increasing taxes in 1993 and streamlining government spending which, along with increasing GDP (tax revenue) led to government surpluses which actually started to pay down the debt. In the 2000s, Bush cut taxes substantially and conditions were established for the banking crisis. Since that time, the accumulated debt and recovery spending from both the 2008 Recession and the COVID-19 pandemic have exploded the national debt and income inequality.

It is estimated that Bush and Trump's cuts have added ~$10T to the US debt over 20 years. This is consistent with the current Republican tax cut extension proposal which is expected to add an additional $4-5T to the debt over the next 10 years15. The US has significantly lower tax revenue than many other countries and when compared to the EU, has significantly more inequality with the EU Gini-index being ~32 -- roughly where the US was before the Reagan administration.

Figure 5: When compared to many other countries, the US collects a much smaller fraction of its GDP in tax revenue and tax policy has not kept pace with GDP growth.

Per one analysis:

The [Bush and Trump tax] cuts have added $10 trillion to the national debt since the Bush tax cuts were enacted in 2001 and Trump’s in 2017, the report finds. In that time, the cuts have caused more than half — 57 percent — of the increase in the debt ratio. That proportion jumps to a whopping 90 percent if the stimulus packages following the Great Recession and COVID-19 recession are excluded from the analysis16.

At the same time, spending has not contributed nearly as significantly to the debt ratio. Before the Bush tax cuts were made permanent in 2012, spending was projected to not exceed revenues for 65 years, the Congressional Budget Office (CBO) estimated — but, the next year, the CBO found revenues were expected to fall below program spending and the debt ratio would begin rising indefinitely17.

There are several different analyses that are done to calculate the impact of tax cuts, but it is certain that the US has a lower rate than many other developed countries and the rate of inequality has consistently increased since these reduced rates have been systematically implemented. This argument is very straightforward and can be seen across multiple dimensions, including sustained policies of tax reductions, aligning with growth in income inequality, expanding government debt, and the divergence between productivity and wages (discussed below).

The Fate of the Middle Class

Increasing inequality has been both a function of wealth concentration and a hollowing out of the middle class. This is an important argument because it largely relates to manufacturing and production which are central topics for the current administration - notably how to restore them in the US. The argument is as follows:

For much of the latter part of the 20th century there was a belief that as production costs dropped, via technology, automation or otherwise, that advanced countries would shift from a goods economy to a services economy (sometimes referred to as a knowledge economy). Low-cost production would be shifted to lower cost of labor regions and the US would benefit from high margin services. What has actually happened, however, is that low cost of production countries like China have started to move up the value chain, developing increasingly sophisticated products that are directly competing with US products while maintaining a depressed currency.

The net effect of this is that manufacturing in the US has been gutted, and now the US is losing competitiveness even on high end technology. This argument is real and has transpired, specifically with China, but has been fueled in large part through both currency suppression and theft of intellectual property18. As discussed in Trade and National Security — this is a very valid reason to impose economic measures against China. The same does not apply to US allies.

Individualism, Free Markets, and Money in Politics

Jeff Bezos recently changed the editorial policy at the Washington Post resulting in the resignation of its editor. From now on they would ONLY print articles that supported the topics of free markets and personal liberty. This is the natural rallying cry of the conservative right. It is a blanket statement that is often used as a fallback or a panacea for all the ills of capitalism.

In the context of the current US, it is simply not true, however, it is a narrative that there are strong incentives to keep alive. We believe that the Internet grants us individual expression while access to over 50% of the world's population is controlled literally by a single individual (Zuckerberg, who, on account of super-voting shares, cannot be removed from his role as CEO even by the Board and even given Meta's status as a public company). The rise in the inequality index in Figure 3 describes the bulk of the story, but in the US, this has been rapidly accelerated by the Supreme Court Decision of Citizens United v. Federal Election Commission in 2010 which famously described money as free speech. This gave rise to the Super Political Action Committee (the super PAC)

Citizens United

In 2007, a conservative nonprofit, Citizens United, challenged the FEC when it prevented them from promoting a film critical of then-candidate Hilary Clinton. In 2010, the Supreme Court ruled that restricting such nonprofits would be a violation of the First Amendment and created the circumstances by which super PACs could arise. In general, there are limits on the amount of money that individuals and corporations can donate to political campaigns. SuperPACs operate outside of these limits because they do not donate specifically to the campaign but just operate in lockstep alongside it. As a consequence, their ability to spend money to promote (or corrupt) politics is unbounded.

The majority opinion stated the following to justify the decision not to distinguish between levels of donation or source:

Corporations and other associations, like individuals, contribute to the ‘discussion, debate, and the dissemination of information and ideas’ that the First Amendment seeks to foster” (quoting Bellotti, 435 U. S., at 783)). The Court has thus rejected the argument that the political speech of corporations or other associations should be treated differently under the First Amendment simply because such associations are not “natural persons.”

All speakers, including individuals and the media, use money amassed from the economic marketplace to fund their speech, and the First Amendment protects the resulting speech19.

The rationale of this decision notwithstanding, the effect should be viewed in context. On both sides of the political spectrum there have been substantial megadonors, however, only one party has systematically implemented tax policies specifically on income over several decades that support the increasing asset wealth of those donors. This is why many ultra wealthy entrepreneurs take a $0 salary. It has been a defining characteristic of US politics since the 1980s. It’s important to note that not all wealth accumulation is a direct consequence of tax policy — for example, government subsidies can provide significant value to businesses even in the context of higher taxes. Democratic environmental policies like carbon credits, or electric vehicle subsidies have provided substantial value to that industry despite the potential for higher corporate taxes. The top end of the capital spectrum may be relatively agnostic to any specific party if it serves their business interests. The Citizens United decision has come in tandem with increases in wealth hyper-concentration driven by hyper-scalable technology like social media.

The combination has resulted in the situation we observed on January 20th, with nearly $1T of wealth personally represented by 5 individuals standing behind the president of the United States during the inauguration. It is emblematic of the system.

Elon Musk contributed nearly $280M to support Trump’s campaign, has threatened to fund primary contenders for any congress person that opposes him and is currently funding swing state supreme court races specifically in critical states such as the Wisconsin Supreme Court race. This is a twofer for corruption as Tesla has active cases pending20 and where a single vote was critical in validating the status of 220,000 Wisconsin votes confirming Biden’s win in the 2020 election21. Musk has funded nearly $17M dollars22 in this race. He is again offering $1M to individual voters who sign petitions — this time against activist judges23, in a call back to the 2024 election in PA where it was for gun-rights and free speech24.

It is immensely important to understand the magnitude of this — there are 218 Republican seats on the House currently. A $10M campaign for any of them would be a serious threat — this would amount to $2.18B in total superPAC funding — for the entire Republican House caucus. This is less than 1% of Musk’s net worth currently. It is an extraordinary state of affairs for money in politics.

Compare and Contrast - US and EU

It is worth taking a moment to compare and contrast the EU and the US on a few dimensions to better understand the nature of this evolution.

The US and the EU have both benefited from the global security and stability that has been a defining characteristic of the post-WW2 world.

Figure 6: Nominal and PPP growth of GDP in EU and US

The two regions grew almost in lockstep for much of the post-WW2 period. After the 2008 financial crisis, the euro began to significantly depreciate which, while nominally GDP has grown, Purchasing Power Parity PPP has stagnated. This was likely a consequence of the different economic policies that were employed during the 2008 Recession as well as complications with the debt of member states like Greece.

An immediate consequence of this is that European exports to the US are cheaper and US exports to Europe, more expensive. Despite this, there is a relatively small overall trade imbalance, though it is differentiated between goods and services. The US ships more services to the EU but receives more goods. Prior to the first Trump administration, tariffs between the US and Europe were minimal.

Figure 7: EU goods/services trade and direct investment with the US over the last few years. The US has a goods trade deficit and a services trade surplus with EU. The total trade is ~$1.6T with a net imbalance of ~3% ($48B) of the total trade volume25

Domestic economics in the EU are generally more socialist, particularly with regard to tax policy and health care. As seen in Figure 5, nearly all EU countries (except Ireland which has some unique IP laws) have tax revenue as a percent of GDP that is significantly higher than the US with top marginal tax rates in France, Denmark, and Austria being 55% or greater compared to the US at 37%.

*It is worth noting that states like California with a high state tax of 13% do make the aggregate top bracket about 50% in the US, however, California is a net tax donor to the US meaning it contributes more than it receives to/from the federal budget.

Higher taxes are used to fund social programs -- medical care is of note as the US spends more than double the EU per capita on healthcare and has poorer outcomes. As one of the primary drivers of the US debt, this is meaningful and is, at least in part, a tax policy matter with regards to federal revenue and a social policy matter with respect to healthcare delivery. The fragmented system in the US is substantially more expensive to operate.

EU politics also do not have an election finance policy comparable to the US. Political spending is much more restricted, and the influence of donors is consequently lower. The EU has nothing comparable to the US superPAC

Similarly, their domestic inequality scores are much lower and much more stable over time.

The EU is similar to the US with the euro as a reserve currency, but it has not matched the US's spending scale -- the current US debt to GDP ratio is 120% whereas Europe is ~85%.

One additional factor, when it comes to economic spending is investment in R&D. The US produces a great deal of new technology that the world ultimately benefits from. US private company investment in R&D is roughly 150% that in Europe and this has been cited as the source of productivity growth. However, productivity growth has nearly entirely accrued to capital, not to labor. Wages have not kept pace.

Figure 8: productivity and compensation have been largely decoupling since ~198026

This largest outstanding question is: when compared, for example, to the EU, where is the US spending so much money? The answers are below:

The US has global military spending, and the EU is largely local

The US has higher per-capital health expenses which is a growing concern

Since 1980, the US has largely pursued an agenda of tax reductions which reduces government revenue

But money does not disappear -- reduced government revenues from lower taxes means that more capital remains in the hands of private citizens. Capital accumulation and compounding over several decades have resulted in the increased inequality index in the US.

The central thesis that drives this inequality is described in Thomas Piketty's book "Capital in the Twenty First Century" - and it is simple (paraphrased):

If the return on capital grows faster than the return on labor, inequality will inevitably grow. This is the defining characteristic of the last several decades27.

The YouTube economics channel, Gary's Economics, states the conclusion of this trend (paraphrased)28

People are aware that inequality is increasing, and economic standards are deteriorating. What they are not as aware of is how it is happening. The narrative being sold is that it is outsiders that are taking advantage of or cheating the US -- this is the Trump narrative and the rationale for the tariff agenda -- but this is to mask the fact that the damage is being self-inflicted, by the very policies that are being voted for. When those with resources conclude that the best message to avoid the remedy of rebalancing is to blame others, they will pour money into that narrative to find a scapegoat, often immigrants, (and this will be limitless under the superPAC paradigm of Citizens United). It is of note that the policy is to both demonize immigrants, but not actually stop immigration. Trump advocated that Republicans actively block border legislation until after the 2024 election almost certainly to use it as a political talking point29. A similar tactic was taken in the 2018 mid-term elections. To make immigration a strong scapegoat, you need active immigration, and you need visible force against it30. The goal is not to solve immigration, it is to create and maintain a scapegoat. And this is exactly what we are seeing now in the Trump administration.

Part 3 - Current and Future State

Part 3 discusses topics related to current economic agenda and the intersection with developments in AI.

The Trump Economic Agenda

There is a policy behind the Trump economic agenda -- and it is a big one -- it is also deeply flawed. An introduction to it is in the references and it was drafted by Stephan Miran who is now the chair of the Council of Economic Advisors31.

The administration is arguing that they are aiming to remake the global financial system, that the US has been cheated by other countries, and that they will bring back manufacturing to the US. The argument for securing more robust supply chains and manufacturing capacity is valid -- the COVID pandemic demonstrated this on the medical front, and I expect we will see this issue on the chip manufacturing front very soon.

There are three pillars to the strategy that need to be viewed together. They intertwine economic, political, and military power, but we will aim to disambiguate them.

Reduce federal spending -- this is presumably the impetus behind DOGE, though the methods appear to have nothing to do with efficiency

The external revenue service -- this is the tagline for tariffs and likely for things like the "Trump Gold Card" which many argue is an avenue for money laundering at scale32.

Reduce taxes -- expected to add ~$400B to the deficit each year. There is no clear way this will be addressed.

The larger objective of the remaking of the financial system aims to accomplish two contradictory goals

Ensure that the USD remains the primary global reserve currency -- the US benefits tremendously from this status

Make US exports more attractive to rebalance trade relationships

The latter point can be accomplished by the following:

Reduce the value of the USD -- this is largely contradictory to the first objective because a reserve currency strengthens the dollar

Dramatically reduce the cost of production of US goods -- this can happen through labor cost reduction (this is where AI/automation comes in) or through wage suppression via manufactured unemployment or recession (this is what DOGE is doing). It has been the administration's policy to "increase the labor supply" which will suppress wages.

Compelling other countries via military force -- this is what the NATO pressure spending is about, the actions in Ukraine, and the saber-rattling about Greenland and Panama which are about military control of east/west trade. Securing control over east/west trade secures the USD as the dominant reserve currency almost independent of US debt concerns, internal corruption or loss of the rule law, or any other factors. It is a might-makes-right approach to global affairs.

In all these cases, the outcome for American citizens is most likely not good and the primary reason is that all of these mechanisms serve to continue the concentration of wealth.

It is also critical to point out that the status of the USD as a reserve currency is dependent on the world's confidence in the US's legal, regulatory, and economic standing. With a debt-to-GDP ratio of 120%, a deteriorating rule-of-law environment, increasing political unrest, and a chaotic decision-making system, this may be more difficult to sustain. This notwithstanding, the USD does not have a major contender yet for reserve currency status.

The challenge with trying to devalue the USD has multiple other downstream consequences. Attempting to deliberately devalue the USD—such as through expansive monetary policy—has significant global repercussions. While such actions may aim to stimulate exports or reduce debt burdens, they simultaneously erode the value of foreign-held U.S. dollar reserves. In response, foreign central banks might adjust interest rates or engage in currency interventions to stabilize their own exchange rates, potentially leading to a feedback loop that disrupts global trade flows. The interdependence of financial systems and capital markets limits the effectiveness of such unilateral devaluation strategies, often triggering unintended inflationary pressures at home and competitive policy adjustments abroad.

It is reminiscent of per Edmund Burke on the French Revolution:

"An ignorant man, who is not fool enough to meddle with his clock, is however sufficiently confident to think he can safely take to pieces, and put together at his pleasure, a moral machine of another guise, importance and complexity, composed of far other wheels, and springs, and balances, and counteracting and co-operating powers. Men little think how immorally they act in rashly meddling with what they do not understand. Their delusive good intention is no sort of excuse for their presumption. They who truly mean well must be fearful of acting ill. (LMNA 196)"

The below section is forward looking and ties together the past and future. The critical idea is that while the Trump economic agenda described above is considered by many to be internally inconsistent. However, perhaps the only path by which it may work is in the context of a dramatic reduction in the cost of production in the US. This is the future portended by AI as envisioned by the Silicon Valley philosophy being adopted in DC. The long-term goal is best described by the philosophy of a Techno-Monarchy. This is a system incompatible with democracy where countries are led as corporations by monarchical “CEOs” as opposed to elected representatives.

AI Techno-Monarchy and DOGE

The most obvious thread that ties this geopolitical economic state together is the introduction of AI and the Silicon Valley takeover of the government in a form of a techno-monarchy described by writer Curtis Yarvin33. Until recently this was an obscure philosophy that envisioned countries being run as corporations with “CEOs” as leaders instead of elected officials. The state becomes an economic enterprise. This is what DOGE is actually about. The DOGE efforts are not really about government efficiency, they are about control. There are telling slips such as in this clip34 where Musk is addressing the Cabinet and slips the word “company” in lieu of “country”.

Musk’s view driving DOGE is that people will be replaced by robots and AI. This is a long-term vision of many technologists with unclear ramifications for society. However, the anticipated result will achieve a significantly lower cost of production, or correspondingly higher productivity, satisfying the balance of maintaining a strong USD while simultaneously having attractively priced US exports (it just leaves the labor out of the loop)

There is a tremendous amount already being written about the impending labor market disruptions from AI. A recent study from the IMF produced the following analysis indicating that upwards of 60% of the jobs in advanced economies will have exposure to AI and 24% will additionally have high complementarity (replacement potential):

Figure 9: Projected impacts of AI on different markets with advanced economies seeing upwards of 24% of jobs potentially replaced on account of both high exposure and high complementary and upwards of 60% total being affected35.

Further Exacerbating Inequality

The concentration of power and wealth that is enabled by the leverage of AI is among the most salient projections. Per the above IMF report:

AI could also affect income and wealth inequality within countries. We may see polarization within income brackets, with workers who can harness AI seeing an increase in their productivity and wages—and those who cannot falling behind…

The effect on labor income will largely depend on the extent to which AI will complement high-income workers. If AI significantly complements higher-income workers, it may lead to a disproportionate increase in their labor income. Moreover, gains in productivity from firms that adopt AI will likely boost capital returns, which may also favor high earners. Both of these phenomena could exacerbate inequality.

In most scenarios, AI will likely worsen overall inequality, a troubling trend that policymakers must proactively address to prevent the technology from further stoking social tensions. It is crucial for countries to establish comprehensive social safety nets and offer retraining programs for vulnerable workers. In doing so, we can make the AI transition more inclusive, protecting livelihoods and curbing inequality.

Specifically, the compounding nature of the economic returns and the value of high quality data, fueled by massive investments in computing power are unlike anything we have seen in the past. The investments in AI infrastructure have been the most dramatic in history with proposals of upward of $500B by just OpenAI, Softbank, and Oracle alone36. It is not without mention that OpenAI is just barely 10 years old as company. Exponentials in this field are difficult to understand, but the below graphic is instructive:

Figure 10: The rate of technology adoption and concentration is exponentially increasing37

For AI applications, data is the primary asset. Access to US government data is almost certainly one of the primary motivations of DOGE as Musk has long expressed a desire to turn the social media company X/Twitter (and his AI company xAI which was launched as competitor to OpenAI) into an "everything app" not unlike WeChat in China which has a nearly universal tap on Chinese citizens. The scale and nature of this type of data is extremely desirable for AI models -- and the acquisition of it in the US by a private company would constitute perhaps the largest single theft in history.

Commerce Secretary Howard Lutnick has said, in a comically cartoonish way, that we will have robots making iPhones in the US shortly and that everyone will have 5 Tesla Optimus robots by 202838. If one were to imagine how US exports could be made economically attractive while not diminishing the status of the USD as the global reserve currency, eliminating the cost of human labor would be one of the only ways to do so. There is no indication that this will have any benefit for American citizens who cannot participate in this economy. The economic value that is accrued to individuals who leverage AI will remain in private hands as a consequence of reduced taxation. This will reduce the spending power of the US consumer base. Independent of whether US tariffs persist and whether they have an impact on federal revenue, reduced economic activity will reduce federal revenues, which will continue to propagate through reduced public services or programs like social security. This will continue to exacerbate inequality which will continue to be marketed by politicians as "foreign invaders" until such time as the system breaks. Musk is on video saying he wants to be the "leader in apocalypse technology"39. It’s hard to tell if it’s a joke.

The topic has been extensively discussed by Sam Altman of OpenAI who has also directly funded research into the post-AI economy and universal basic income.40.

This study naturally indicates that Universal Basic Income (UBI) has positive benefit, but it does not discount the broader expectations41

More to the point, a world in which this dynamic exists is dystopian and feudal in nature. Indeed, the former Greek Finance Minister Yanis Varoufakis has labelled this as “Technofeudalism”42 even as it exists today. A future of continual resource capture is one that current administration is almost certainly planning.

There is Room for Optimism

The room for optimism is that this outcome is unlikely at least in the near term. It is very important to be clear that the impact of AI will be very real. I am also a strong proponent of the ability of technology to improve the world. It is, however, much more likely to be a tool of power, particularly in politics, than one of production, and the merging of politics and business, particularly in places like China, Russia, and most recently, the US, makes this much more likely to lead to dystopian outcomes than ideal ones.

That said, the timelines for the transformation of the American economy are almost certainly longer than projected -- although it can be rapid. One of the most important aspects of this transformation, however, is that it is being driven by private companies and not by the government which can make both scale and implementation much more rapid. However, from a foreign investment perspective, the approach being taken by the current administration is more likely to stall progress than accelerate it because it is inducing substantial international resistance and retaliation.

Despite the size and strength of the American economy, it remains heavily integrated with other countries and the antagonistic and chaotic approach being taken now is creating what some consider to be an "uninvestable scenario in the US". It is particularly of note that Commerce Secretary Lutnick has fired the volunteer Federal Economics Statistics Advisory Committee which was established to provide independent advisory support on the calculation of government statistics, and as recently as Oct 2024 had their charter renewed as being "in the public interest"4344. It is highly likely that economic indicators from the Trump administration will be manipulated (in Lutnick's terminology they will "recalculate" them).

A Better Path

The US is in an imperialist mode right now, both politically and economically, in both the public and private sectors. There seems to be a desire to retract from global integration and engage through unilateral, transactional agreements, informed by both sticks and carrots. I expect this is unlikely to be sustainable in the current integrated world and efforts to brute force it will result in long-term damage to both global stability and the economic well-being of many countries.

It is, however, critical that the US controls more of its supply chain and it is critical to invest heavily in strategic industries like chip manufacturing, and biotech, but this can be done much more effectively with allies than enemies and right now the Trump administration is accruing an unnecessarily large international enemies list.

The US should provide financial and tax incentives for foreign companies to build in the US. The US should not eliminate prosecution of laws against bribing foreign officials.

The US should create a tax policy that funds the current obligations while rapidly implementing more robust government efficiency measures to reduce spending in a legal and thoughtful manner -- this can include more aggressive medical care cost management, for example. The US should not endorse hostile takeovers of federal buildings by DOGE.

The US should continue to support global alliances that further its sphere of influence, as long-term this is less expensive than war. The US should not abdicate soft power influence to be filled by foreign countries like China's Belt and Road Initiative.

The US should take AI seriously and ensure that the US is a global leader. The US should not become a domestic surveillance state.

The US should focus extensively on ensuring the pace of skill acquisition in its labor force is keeping pace with technological advances such that labor will continue to be able to capture value as this new economy develops. The US should not promote or seek policies that aim to centralize value or power capture, either political or economic.

Closing where we began with Keynes -- nearly all things in the history of people can be distilled to economics -- the narrative of the US is no different. The global presence of the US has been a narrative of one human lifetime (80 years) since the end of WW2. Half of that has set up the conditions for widespread prosperity and the second half has been about concentrating it.

The key takeaway amid all the current turmoil is that the agenda being pursued is not one in favor of America writ large. The objectives are contradictory and inconsistent save for a very narrow path and achieving that path in the way the administration is approaching it will not likely result in increased prosperity for most people.

Returning to Autonomous Organizations

This article started off with the idea of Autonomous Organizations and what is being made possible through advances in AI. This is still the future, and it will come. The most significant sociopolitical decision of the coming years will be how to manage the impacts. I view a world where individuals can create value at scale leveraging AI. An alternative view is where individuals or companies extract value leveraging AI. The history of Silicon Valley has been defined by the extraction and concentration of value — this is not to say that technological advances have not provided value in return — how would we all live with GoogleMaps? — but it has been highly asymmetrical. The book Chaos Monkeys45 describes it well (and yes, there is irony that I provided an Amazon link to the book).

The development of powerful AI systems will rapidly accelerate both power and resource concentration if the socioeconomic structures, policies, and laws of a society do not mitigate it. For fans of science fiction — this generally does not result in long-term stability or prosperity. We should aspire to aim higher.

References

Below is the comprehensive list of references, but for a much more detailed view of the administration’s policy direction the article by Stephan Miran is the source. It is a technically dense document but useful for those interested:

Building Autonomous Organizations

TLDR: This article is written as a short primer for a general audience on the introduction of AI agents in building autonomous organizations — or key trends in that direction. Along the lines of the rest of this Substack, it is a personal experiential perspective on how individuals can develop highly leveragable tools, particularly in knowledge domains…

https://www.cnbc.com/video/2025/02/10/nec-director-kevin-hassett-on-new-metal-tariffs-trumps-reciprocal-tariff-plan-and-tax-priorities.html

https://truthout.org/articles/report-trump-bush-tax-cuts-have-largely-driven-national-debt-issues-since-2001/

https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

https://www.bizjournals.com/milwaukee/news/2025/03/12/harley-davidson-faces-50-eu-tariff.html

https://www.visualcapitalist.com/largest-defense-budgets-in-the-world/

https://www.rand.org/content/dam/rand/pubs/monograph_reports/2005/MR1746.pdf

https://www.nato.int/nato_static_fl2014/assets/pdf/2024/6/pdf/240617-def-exp-2024-en.pdf

https://www.csis.org/analysis/nato-and-claim-us-bears-70-burden-false-and-dysfunctional-approach-burdensharing

https://qz.com/elon-musk-illegal-immigration-tesla-video-1851379406

https://www.reuters.com/business/aerospace-defense/eu-proposes-joint-defence-push-amid-russia-fears-us-worries-2025-03-19/

https://usafacts.org/articles/which-countries-own-the-most-us-debt/

https://data.worldbank.org/indicator/SI.POV.GINI

https://ourworldindata.org/grapher/economic-inequality-gini-index

https://www.crfb.org/blogs/tcja-extension-could-add-4-5-trillion-deficits

https://www.commondreams.org/news/trump-bush-tax-cuts-fuel-growing-deficits

https://truthout.org/articles/report-trump-bush-tax-cuts-have-largely-driven-national-debt-issues-since-2001/

https://www.newsweek.com/china-intellectual-property-theft-fbi-linda-sun-hochul-infiltration-1950686

https://www.fec.gov/resources/legal-resources/litigation/cu_sc08_opinion.pdf

https://www.wpr.org/news/elon-musk-pac-millions-wisconsin-supreme-court-race-tesla-lawsuit

https://www.pbs.org/newshour/politics/wisconsin-confirms-joe-biden-as-winner-following-recount

https://www.theguardian.com/us-news/2025/mar/02/elon-musk-wisconsin

https://www.independent.co.uk/news/world/americas/us-politics/elon-musk-voters-wisconsin-supreme-court-b2722480.html

https://www.theguardian.com/us-news/2024/oct/21/election-shapiro-musk-1-million-giveaway

https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/united-states_en

https://www.epi.org/blog/growing-inequalities-reflecting-growing-employer-power-have-generated-a-productivity-pay-gap-since-1979-productivity-has-grown-3-5-times-as-much-as-pay-for-the-typical-worker/

https://en.wikipedia.org/wiki/Capital_in_the_Twenty-First_Century

www.youtube.com/watch?v=wPoXOwiEfrQ

https://abcnews.go.com/Politics/trumps-grip-congressional-republicans-casts-doubt-border-deal/story?id=106708196

www.youtube.com/watch?v=dsNzmKXDPMA

https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

https://www.reuters.com/world/us/trump-end-eb-5-immigrant-investor-visa-program-2025-02-25/

https://en.wikipedia.org/wiki/Curtis_Yarvin

www.youtube.com/watch?v=9DLtwUFwpTY&t=295s (time point 4:55)

https://www.imf.org/en/Blogs/Articles/2024/01/14/ai-will-transform-the-global-economy-lets-make-sure-it-benefits-humanity

https://www.forbes.com/sites/garthfriesen/2025/01/23/trumps-ai-push-understanding-the-500-billion-stargate-initiative/

https://www.linkedin.com/pulse/5-days-100m-technological-adoption-rates-skyrocketing-rootitnow/

https://fortune.com/2025/03/20/howard-lutnick-pumps-tesla-stock/

www.youtube.com/watch?v=O3BH8edQVZ4 (1:43 time point)

https://www.bloomberg.com/news/articles/2024-07-22/ubi-study-backed-by-openai-s-sam-altman-bolsters-support-for-basic-income

https://futurism.com/ai-increase-inequality-sam-altman-admits

https://www.penguinrandomhouse.com/books/751443/technofeudalism-by-yanis-varoufakis/

https://apps.bea.gov/fesac/

https://www.federalregister.gov/documents/2024/10/22/2024-24484/federal-economic-statistics-advisory-committee

https://www.amazon.com/dp/0062458205?tag=bravesoftwa04-20&linkCode=osi&th=1&psc=1&language=en_US

Amazing piece! Loved how you detailed the series of economic decisions fueled by global events that's led the US to it's current state.